Is an Actuary like someone with the fortune telling Orb in the middle tent of the fair? No? So is it someone who sits on a river bank in saffron and tells us our future? Not even that?! So then, what exactly is the role of an Actuary, let’s find out in the blog below.

To begin with, let’s make our peace with the fact that an Actuary’s role in the real world is just as crucial as the pair of oars to its boat are. So, as an Actuary, your skills to analyse risks using your advanced analytical and statistical skills give you a superpower to identify and analyse the risks in the finances. Your expertise in fields like mathematics, economics,

computer science, finance and business is what counts as the irreplaceable feather in your cap that will take your Actuarial career further.

So now that we are talking about the importance of you as an Actuary, why not dig a little deeper into the role that an actuary plays and the career options that he/she has?! Flock through the blog to find out more.

Insurance Industry

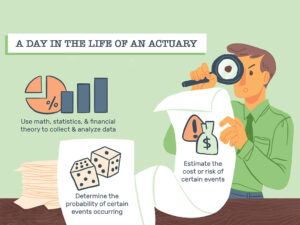

Let’s start with the basics! If you’re stepping into a finance related firm, it’s bound to be risky. This is where Actuaries come in! Actuaries play a very crucial role in the insurance industry by using their mathematical and analytical skills to skim through the risks and trends in the insurance market and thus, make themselves a key player by assessing the profitability of the insurance business.

Life Insurance

When it comes to life, nothing can be predicted. That’s what normal people think! You, as an Actuary, can actually evaluate the risk in insuring a life by estimating the days in his/her life (on an average though). So yeah, you are the witch in the fair, just instead of an orb you have a desktop on your table.

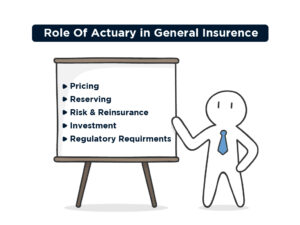

General Insurance

In the field of general insurance, actuaries are employed to assist with the management of finance. Apart from that, Actuaries are also employed to manage their broking operations and reinsurance. And then, there’s of course, risk management where your analytical skills are deployed.

Pension Actuary

Pension actuaries work alongside specialised staff like pension lawyers and help analyse the present trends, predict the future trends and thus, help formulate policies and schemes.

So, you as an actuary would be looking into everything from scheme funding and designing to risk management, accounting, individual benefits and a lot more.

Finance and Investment

● Financial Services: Several financial institutions hire actuaries to assess and predict the risks on loan products in near future. Thus, an actuary can actually use their analytical skills in the field of corporate finance and make it more beneficial for investment bankers to invest.

● Investment regulations: Clearly, investing, as they call it, is being “subject to market risks”. Wherever the term ‘risk’ is involved, actuary is imperative. Actuaries analyse the market situations using their skills and make buying and selling of assets more profitable. Sounds like a deal, doesn’t it?!